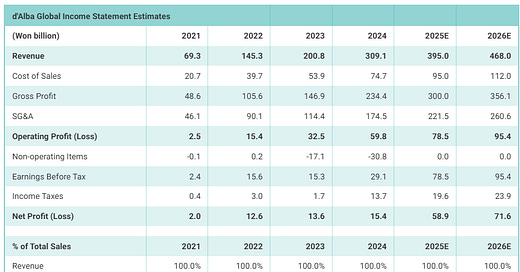

Our base case valuation is based on a P/E of 21.9x (40% premium to the comps) our estimated net profit of 58.9 billion won in 2025.

We believe d'Alba Global should trade at a premium valuation to the comps due to higher sales and operating profit growth, higher ROE and operating margins than the comps.

Our base case valuation of d'Alba Global target price of 101,609 won per share, which represents 53% higher than the high end of the IPO valuation range.

Keep reading with a 7-day free trial

Subscribe to Douglas Research Insights to keep reading this post and get 7 days of free access to the full post archives.