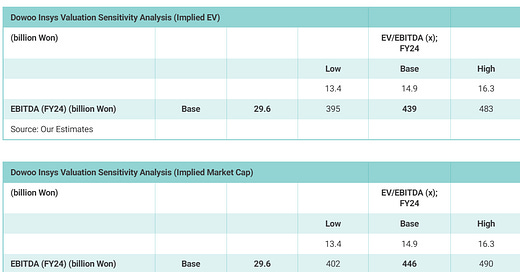

Our base case valuation of Dowoo Insys is target price of 40,667 won per share, which is 27% higher than the high end of the IPO price range (32,000 won).

We used an EV/EBITDA multiple of 14.9x to value the company, which is 10% premium to the comps' valuation multiples in 2024.

The decline in operating margin remains one of the biggest risk factors on the company. Its major customers such as Samsung Display are putting increasing pressure to reduce its prices.

Keep reading with a 7-day free trial

Subscribe to Douglas Research Insights to keep reading this post and get 7 days of free access to the full post archives.