On 3 May, it was reported that Hankook Tire & Technology agreed to purchase a 25% in Hanon Systems for 1.37 trillion won from Hahn & Co private equity firm.

After this deal, Hankook Tire & Technology will own a controlling 50.5% stake in Hanon Systems.

We have a negative view on Hankook Tire & Technology's additional purchase of Hanon Systems, which has experienced a declining profit margins in the past several years.

Conclusion First - Our Thoughts on Hankook Tire & Technology's Additional Purchase of Hanon Systems

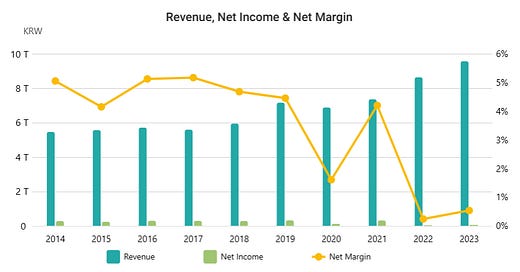

We have a negative view on Hankook Tire & Technology's additional purchase of Hanon Systems, which has experienced a declining profit margins in the past several years. Hanon System's net margins were consistently in the 4% to 5% range from 2014 to 2019. Its net margins declined from 4.2% in 2020 to 0.2% in 2021 and 0.5% in 2022.

Many investors are still highly skeptical of Hanon System's ability to generate a strong turnaround in its profit margins. This is a key reason why its share price has declined so much in the past three years. Hanon System's share price has declined by nearly 65% since its highs in March 2021.

Hanon Systems' ROE averaged 5.6% in the past three years and 1.6% in the past two years. On the other hand, Hankook Tire & Technology's ROE averaged 7.9% in the past three years and 8% in the past two years. Given higher ROE for Hankook T&T versus Hanon Systems, many investors would prefer Hankook T&T to reinvest in its core tire making business, pay out higher dividends, and buy back/cancel shares, rather than invest in Hanon Systems which has lower ROE.

Therefore, we believe Hankook Tire & Technology's shares could face near term weakness many investors prefer that the company would rather allocate its capital on its own core tire business. We also believe that this deal is not likely to have a positive impact on Hanon Systems since it lacks any upside angle for general shareholders such as through partial tender offer.

Keep reading with a 7-day free trial

Subscribe to Douglas Research Insights to keep reading this post and get 7 days of free access to the full post archives.