FnGuide has been able to capitalize on its excellent brand name in the financial industry (especially for research used in equity trading) to profitably expand into the index development business.

Although the index business accounted for 25% of its sales in 2024, it has been the fastest growing business in the past six years.

Valuations are reasonable and it is trading at 27% below four year historical EV/EBITDA basis. We like FnGuide as a long-term investment story.

Conclusion First

FnGuide has been able to capitalize on its excellent brand name in the financial industry (especially for research used in equity trading) to profitably expand into the index development business. Although the index business accounted for 25% of its sales in 2024, it has been the fastest growing business in the past six years. As passive/index/ETF investing becomes more important in Korea, FnGuide could be one of the key companies to capitalize on this trend.

There is no longer an M&A fight for FnGuide and the company has hired a new, reputable CEO in February 2025. The company has improved its balance sheet in the past couple of years and it had excellent results in 1Q 2025. Valuations are reasonable and it is trading at 27% below four year historical EV/EBITDA basis. We like FnGuide as a long-term investment story.

FnGuide Sales Breakdown

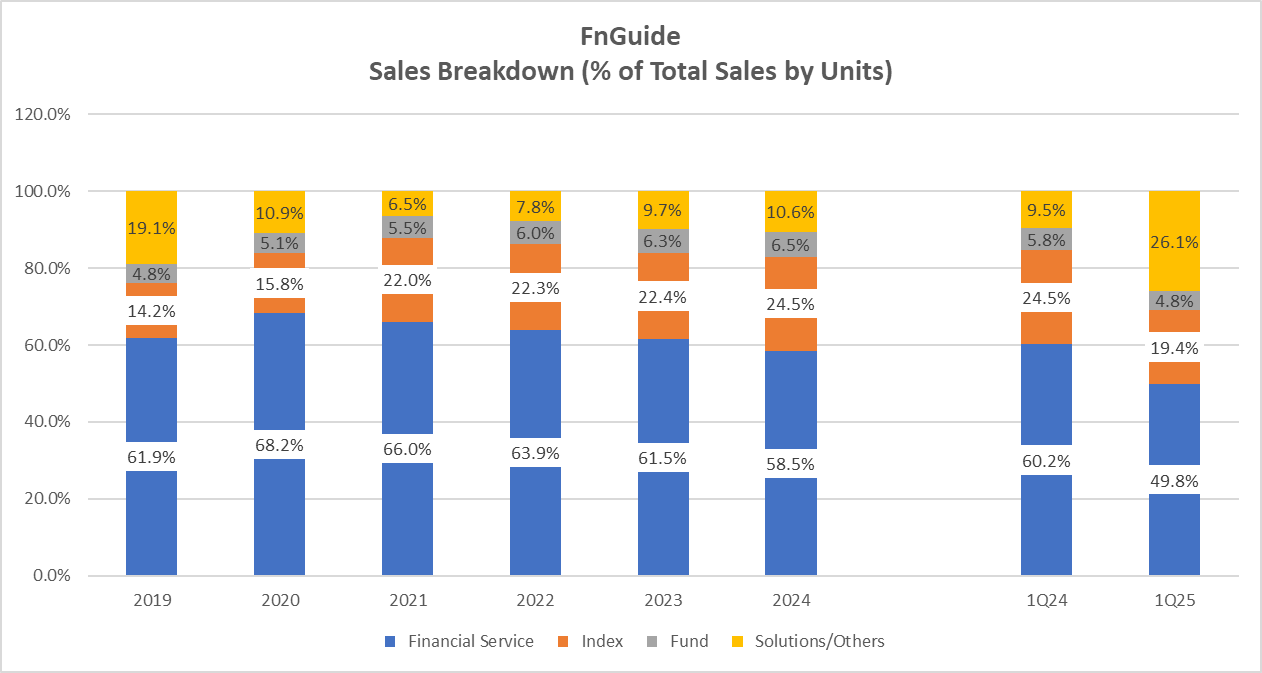

The company breaks down its sales into four main components including Financial Service, Index, Fund, and Solutions/Others. Financial Service as a percentage of total sales accounted for 58.5%, followed by Index (24.5%), Fund (6.5%), and Solutions/Others (10.6%) in 2024.

From 2019 to 2024, the company's total sales increased by 49.8%. The Index business generated highest sales growth (158%), followed by Fund (103%), and Financial Service (41.4%). Solutions/Others experienced a decline of 16.8% in sales in this period.

Source: Company data

Keep reading with a 7-day free trial

Subscribe to Douglas Research Insights to keep reading this post and get 7 days of free access to the full post archives.